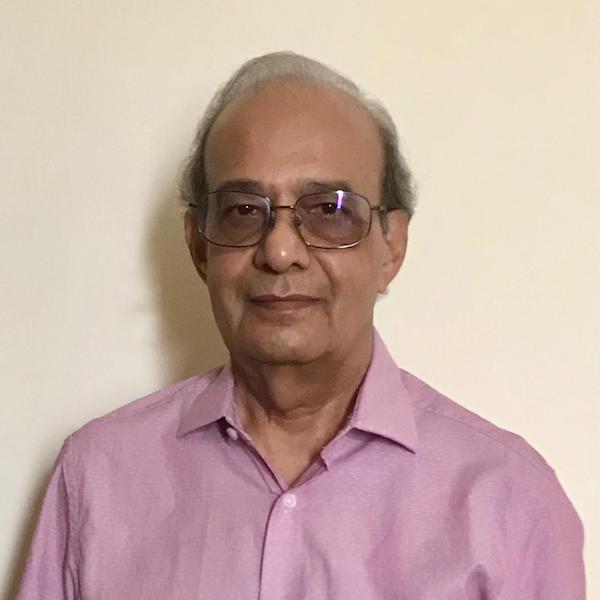

Ajay Banga featured on TIME100 Climate list cover

Besides ‘titan’ Banga, two other Indian Americans— Gaurav Sant, and Sandeep Nijhawan— featured among ‘innovators’

By Arun Kumar

Ajay Banga, Indian American president of the World Bank, is featured on the cover of TIME100 Climate list of influential climate leaders in business this year, with finance encapsulating the climate story of 2024.

Time says it listed Banga among the ‘Titans’ as “around the world, decision makers, executives, researchers, and innovators are working to help unlock the necessary funding and resources needed to drive successful and equitable climate action.”

READ: Juie Shah accepted into Forbes Communications Council (November 14th, 2024)

Banga, who entered the job in 2023 with aspirations of making it less risky for the private sector to invest in the energy transition in the Global South, has woven climate priorities into its mission, it says.

The second annual TIME100 Climate list “represents multitudes of individuals making significant progress in influencing the business of climate change,” it adds.

Besides Banga, the list features two other Indian Americans — Gaurav Sant, and Sandeep Nijhawan — among “innovators and two Indian business leaders — Sumant Sinha and Madhur Jain among ‘catalysts’ and ‘defenders.’

Banga entered office in 2023 after his controversial predecessor, David Malpass, was forced to resign following controversial remarks that seemed to doubt the science of climate change.

Under his leadership, the bank has added climate to its mission statement. To implement his agenda, he has pursued a range of seemingly small reforms that can have a big impact accelerating global climate action and intertwining it with the bank’s long-standing development agenda, Time says.

He has tweaked the rules about how much the World Bank can lend, freeing up space to finance more climate projects. He has sought to integrate climate change into other development programs, from agriculture to education, it says.

And he has worked closely with the private sector in hopes that companies will step up to invest the lion’s share of the trillions of dollars needed to pay for expanding clean energy in the Global South, according to Time. “There’s a whole Rubik’s Cube to be solved,” he says. “If it begins to make sense numerically, money does flood in.”

However, the World Bank won’t be able to fill the massive climate finance gap on its own. The bank manages hundreds of billions of dollars in investments; climate change requires annual investments that measure in the trillions.

Banga’s solution is private finance, Time says. The owners and managers of trillions of dollars in capital have said they want to invest in the energy transition, but a flurry of risks have held them back. “This idea that you can wave a wand and get the private sector to come in … it’s not how it works,” says Banga.

But Banga thinks he can bridge the gap. Since taking office, he has launched a Private Sector Investment Lab working with the CEOs of BlackRock, HSBC, and other big financial institutions to work through the biggest challenges holding back private investment, from currency risk to a lack of regulatory certainty.

Banga addresses widespread concern that now-President elect Donald Trump may not like his agenda, saying that his work at the bank is “common sense” and “has nothing to do with politics.”

“Smart management of money… Who’s going to say no to that?” he asks almost incredulously. “The fact that I’m willing to do more work with the private sector, you really think President Trump will say no to that?”

Among the ‘Innovators,’ Gaurav Sant is the founder of Equatic, a startup building North America’s first commercial-scale ocean-based carbon removal facility.

Led by Sant, who is also the Director of UCLA’s Institute for Carbon Management, Equatic enhances the ocean’s natural ability to trap and store carbon by running an electrical current through captured seawater at its facility.

This year the company started manufacturing a breakthrough anode that it says promises to allow it to also use this process to safely produce green hydrogen that can be sold to help make carbon removal affordable at scale. Equatic says its Canada plant will remove 109,500 metric tons of CO2 and produce 3,600 metric tons of green hydrogen in its first year.

The other innovator, Sandeep Nijhawan co-founded Colorado-based Electra in 2020. Its mission: to decarbonize iron- and steelmaking. Iron production is a hot, energy-intensive process. Today, the steel industry is responsible for about 7% of all global carbon emissions (90% of which come from making iron).

But through a novel electrochemical process, powered by renewable energy, Electra is trying to change that. In March, it launched a pilot plant to produce iron at the temperature of a cup of coffee.

And in April, the company was awarded over $2.8 million from the US Energy Department to support this effort, which brings with it the promise of making steel with 80% less emissions at half the cost of traditional methods.

Nijhawan, for his part, contends that a global price on carbon is needed to push companies to adopt tech like Electra’s and accelerate industrial decarbonization.

Among the ‘Catalysts,’ Sumant Sinha founded ReNew in 2011, which has become one of India’s top renewable energy producers, building wind and solar plants across the country to help meet its burgeoning energy demand.

“Faster electrification is key to transitioning to a low-carbon economy,” he says. “We must aim for electricity to meet half of global energy demand by 2040.”

With his ReNew platform, Sinha has become a leading voice in India and around the world advocating for the policies necessary to advance the energy transition.This year, Sinha was appointed to co-chair the World Economic Forum’s Alliance of CEO Climate Leaders, a group of more than 130 CEOs from some of the world’s largest companies.

Sinha’s mission is to help these companies move forward with their own decarbonization efforts while also pushing policymakers for helpful rules. “You see good momentum in that group,” he says. “It gives you hope.”

Among the ‘Defenders,’ Madhur Jain is CEO of Varaha, a company incentivizing sustainable farming in South Asia and Africa by paying smallholder farmers to use regenerative practices that keep carbon in the ground.

Varaha quantifies the emissions prevented by these practices, selling high-quality carbon credits on some of the world’s leading carbon marketplaces.

With more than 80,000 farmers onboarded and 700,000 acres covered across India, Bangladesh, Nepal, and Kenya, Varaha estimates it has sequestered 1.7 million metric tons of carbon dioxide. In February it raised $8.7 million to expand its operations across Southeast Asia and East Africa.